In the competitive world of forex trading, choosing the right trading platform can significantly impact your success. Selecting a platform that offers the necessary tools, resources, and user-friendly interface is crucial for both beginners and experienced traders alike. Here, we delve into the best platforms for forex trading, examining their features, advantages, and disadvantages, to help you find your ideal trading environment. If you’re in search of reliable information regarding forex brokers in Cambodia, you can check out best platform forex trading Cambodia Brokers.

Understanding Forex Trading Platforms

A forex trading platform serves as the gateway for traders to access the forex market. These platforms provide various services, including charting tools, market insights, direct trading capabilities, and risk management features. Selecting the right platform can enhance your trading experience, allowing you to execute trades efficiently and effectively.

Key Features of a Good Forex Trading Platform

- User Experience: An intuitive interface is essential for both novice and professional traders. A well-designed platform provides ease of navigation, enabling traders to execute trades quickly and manage their accounts efficiently.

- Market Access: Good platforms should offer extensive market access, allowing traders to trade various currency pairs and other instruments like commodities, stocks, and cryptocurrencies.

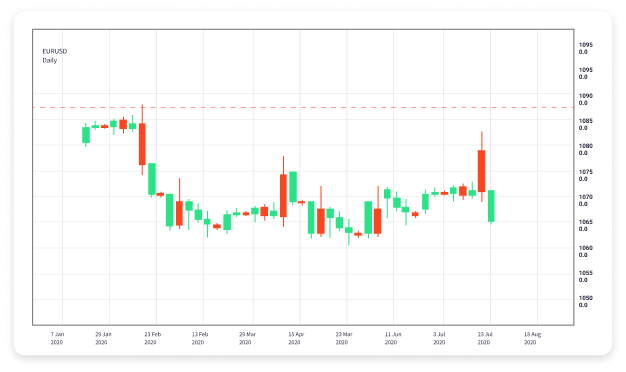

- Charting and Analysis Tools: Advanced charting tools help traders analyze market trends and make informed decisions. Look for platforms that offer real-time data, indicators, and analytical tools to improve your trading strategies.

- Execution Speed: Fast execution speeds are crucial in forex trading. A reputable platform ensures that trade orders are executed quickly without unnecessary delays, which can be critical during volatile market conditions.

- Security: Given the sensitive nature of financial transactions, a reliable platform should provide robust security measures. Look for platforms that offer two-factor authentication and encryption to protect your personal and financial information.

- Customer Support: Efficient customer service can be a lifesaver when you encounter issues. Choose platforms that offer multiple support channels, including live chat, email, and phone support.

Top Forex Trading Platforms

1. MetaTrader 4 (MT4)

MetaTrader 4 is one of the most popular trading platforms globally, known for its user-friendly interface and robust trading tools. It supports automated trading through Expert Advisors (EAs), allowing traders to develop and implement their strategies. MT4 offers a wide range of technical indicators and charts, making it an excellent choice for technical analysis.

2. MetaTrader 5 (MT5)

Building on the success of MT4, MetaTrader 5 includes additional features such as more timeframes, an economic calendar, and improved charting tools. It also allows for trading in other markets, such as stocks and commodities. MT5 appeals to traders looking for a comprehensive trading platform with a variety of features.

3. cTrader

cTrader is known for its innovative design and features, aimed at both beginner and experienced traders. It offers advanced charting capabilities, a wide array of technical indicators, and a user-friendly interface. cTrader also provides a unique feature called „cAlgo,“ which enables traders to create their automated trading solutions.

4. TradingView

While primarily a charting platform, TradingView allows users to analyze various markets and share trading ideas. It is widely recognized for its social trading features, enabling traders to follow and replicate other successful traders‘ strategies. TradingView is perfect for traders who prioritize technical analysis and community interaction over direct trading.

5. NinjaTrader

NinjaTrader is another robust platform, particularly favored by futures and forex traders. Its strong suite of charting tools and market analysis capabilities make it ideal for day traders. Additionally, NinjaTrader provides various educational resources to help traders improve their skills.

How to Choose the Right Forex Trading Platform

Choosing a trading platform should be based on your trading style, experience level, and specific needs. Here are some points to consider:

- Assess Your Trading Strategy: Identify whether you are a day trader, swing trader, or long-term investor, as different platforms cater to different trading styles.

- Check Fees: Ensure you understand the cost structure of the platform. Compare spreads, commissions, and any other fees associated with trading.

- Trial Before You Commit: Many platforms offer demo accounts. Take advantage of these to test the platform’s features and performance without risking real money.

- Read Reviews: Look for user experiences and reviews to gauge the reliability and effectiveness of the platform.

Conclusion

Finding the best platform for forex trading requires careful consideration of various factors, including ease of use, market access, and the tools available for analysis and execution. Whether you choose MetaTrader 4, MetaTrader 5, cTrader, TradingView, or NinjaTrader, the right platform should align with your trading goals and preferences. Always take the time to research and test different platforms to arrive at a decision that will contribute to your trading success.