Forex trading has gained immense popularity worldwide, with individuals seeking opportunities to profit from currency fluctuations. However, for Muslim traders, the question of whether forex trading is halal (permissible) or haram (forbidden) is a significant concern. In this article, we will delve deep into the principles of Islamic finance, the specifics of forex trading, and ultimately analyze whether engaging in this form of trading can align with Islamic beliefs. If you’re interested in practical trading solutions, you can check out forex trading halal or haram https://trading-terminal.com/.

Understanding Islamic Finance

Before we can answer the question of whether forex trading is acceptable under Islamic law, it’s essential to understand the principles of Islamic finance. Islamic finance is rooted in Sharia, which guides financial transactions based on ethical and moral values rather than profit maximization alone.

1. **Riba (Usury)**: One of the core prohibitions in Islamic finance is riba, which refers to the practice of charging interest. Any loan or transaction that generates interest is considered haram.

2. **Gharar (Uncertainty)**: Islamic finance also prohibits transactions characterized by excessive uncertainty or ambiguity. This includes speculative investments that lack real economic justification.

3. **Maysir (Gambling)**: Any form of gambling or betting is not permitted within Islamic finance. This includes trading practices that resemble gambling, where the outcomes are purely based on chance rather than informed decision-making.

What is Forex Trading?

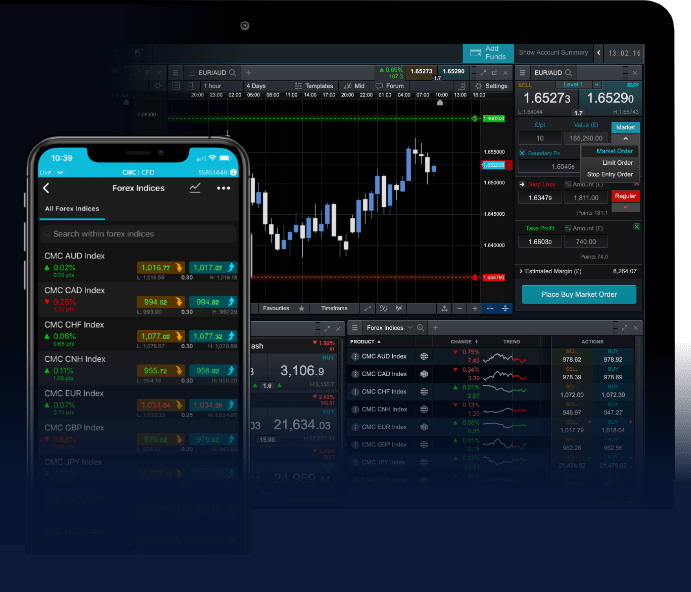

Forex trading involves exchanging one currency for another in the foreign exchange market. Traders speculate on currency pairs, attempting to profit from fluctuations in exchange rates. This market operates 24 hours a day and is known for its high liquidity and volatility.

The mechanics of forex trading can be overwhelming for beginners. However, understanding the details can help clarify whether it aligns with Islamic principles. Traders analyze economic indicators, geopolitical events, and market trends to make informed trading decisions.

Is Forex Trading Halal or Haram?

The question of whether forex trading is halal or haram does not have a straightforward answer and often depends on various factors. Here are the considerations to keep in mind:

1. Presence of Riba

Many traditional forex trading platforms involve the charging of interest on overnight positions, known as rollover or swap fees. This practice can classify the trading as partaking in riba. Sharia-compliant brokers offer accounts without overnight swaps to address this concern.

If a trader engages with a broker that does not charge riba, then it is possible for forex trading to be considered halal.

2. Gharar and Speculation

Forex trading can be speculative, leading some scholars to equate it with gambling (maysir). However, if the trading strategy is based on thorough analysis and informed decision-making, it may not fall under the category of maysir.

It’s crucial for traders to create a solid trading plan that relies on market research and analysis. Swing trading, day trading, or long-term investing based on fundamental analysis can be acceptable practices within the realm of Islamic principles.

3. Brokers and Trading Conditions

Selecting the right broker is essential to ensure compliance with Islamic principles. Many brokers offer Islamic accounts designed for Muslim traders that adhere to Sharia law by eliminating swap fees and offering transparent trading conditions.

4. Ethical Trading Practices

Trading in a manner consistent with Islamic values is important. This means avoiding unethical practices such as market manipulation or exploiting sensitive information. Engaging in ethical trading can reinforce the case for forex trading being halal.

Pursuing Halal Trading Strategies

To engage in halal forex trading, traders can consider the following strategies:

- Using Islamic Accounts: As mentioned earlier, seeking out brokers that offer Islamic accounts is key. These accounts provide conditions that comply with Sharia law.

- Risk Management: Implementing risk management techniques such as stop-loss orders can help mitigate excessive risk and align trading with Islamic principles.

- Research and Education: Continually enhancing knowledge about forex trading through education and market analysis can help traders make informed decisions that adhere to Islamic guidelines.

Consultation with Scholars

Given the complexity surrounding the issue, consulting with a knowledgeable Islamic scholar can provide clarity and guidance tailored to individual circumstances. Scholars can weigh the particulars of a trader’s strategy and broker choice againt Islamic rulings to derive an informed opinion.

Conclusion

Ultimately, the question of whether forex trading is halal or haram hinges on various factors, including the practices of the chosen broker and the trader’s approach to trading. By avoiding interest, reducing uncertainty, employing ethical trading practices, and choosing the right broker, forex trading can be aligned with Islamic finance principles.

As the global financial landscape continues to evolve, more Muslim traders are entering the forex market. By being knowledgeable and diligent, traders can navigate this space in a manner consistent with their beliefs, ensuring their trading endeavors are both ethical and profitable.