Forex Trading vs. Stock Trading: Which Investment Is Right for You?

In the world of investment, traders often face the decision of whether to trade in the foreign exchange market or in the stock market. Both options have unique prospects and challenges, and understanding these distinctions is vital for anyone looking to maximize their investment strategy. In this article, we will compare Forex trading and stock trading, examining their characteristics, advantages, disadvantages, and general guidelines for choosing the right avenue for your trading ambitions. For more insights on trading strategies and education, check out trading forex vs stocks Trading PH.

What is Forex Trading?

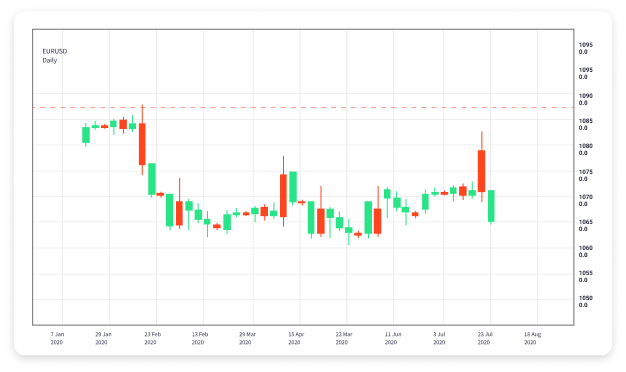

The foreign exchange market, commonly known as Forex, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock trading, where traders buy and sell shares of public companies, Forex trading involves trading currency pairs. Traders speculate on the rise or fall of one currency against another, such as the euro against the US dollar (EUR/USD).

Advantages of Forex Trading

- High Liquidity: The Forex market operates 24 hours a day, five days a week, and is known for its high liquidity. This means traders can enter and exit positions with ease.

- Lower Capital Requirements: Many Forex brokers offer trading with high leverage, allowing traders to control larger positions with a relatively small amount of capital.

- Diverse Options: With thousands of currency pairs available, Forex traders have numerous trading opportunities.

- Less Market Manipulation: Due to its vast size, the Forex market is less susceptible to manipulation by a single entity, compared to individual stock markets.

Disadvantages of Forex Trading

- High Risk: While leverage can amplify profits, it can also lead to significant losses, making risk management crucial for Forex traders.

- Complexity: The factors influencing currency prices (such as geopolitical events and economic indicators) can be complex and require keen analytical skills.

- Limited Regulations: The Forex market is decentralized and less regulated than stock markets, which can expose traders to unethical broker practices.

What is Stock Trading?

Stock trading involves buying and selling shares of publicly traded companies. Trading can take place on various stock exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq. Investors in stocks often look to purchase shares of companies they believe will grow and increase in value over time.

Advantages of Stock Trading

- Stability and Transparency: Stock markets are generally more regulated than Forex markets, providing a level of safety and transparency for investors.

- Potential for Dividends: Stock investors can receive dividends as a form of income, in addition to capital gains.

- Long-Term Growth: Stocks are typically seen as long-term investments that can appreciate over time, especially blue-chip stocks.

- Research Resources: There is a wealth of information and analysis available for traders, making it easier to understand company performance and market trends.

Disadvantages of Stock Trading

- Market Hours: Stock trading is limited to market hours, which can restrict trading opportunities compared to the 24/5 availability of Forex.

- Higher Capital Requirements: Buying shares often requires substantial capital upfront, especially for higher-priced stocks.

- Market Manipulation Risks: Individual stocks can be subject to manipulation by larger entities, which can affect stock prices.

Comparing Trading Costs

Understanding the costs associated with trading is crucial for both Forex and stock traders. In Forex trading, costs are usually incorporated into the spread (the difference between the buy and sell price), and overnight financing fees for holding position can apply. Meanwhile, stock trading often includes commission fees per trade, which can vary significantly among brokers, as well as potential taxes on capital gains.

Choosing Your Trading Style

The decision between Forex and stock trading can often depend on your trading style and risk tolerance. Forex trading is typically favored by day traders and scalpers who may wish to take advantage of short-term price movements. On the other hand, stock trading might appeal more to long-term investors who are comfortable holding assets over extended periods.

Final Thoughts

Whether you choose to trade Forex or stocks ultimately comes down to your personal preferences, goals, and trading style. Both markets present unique opportunities and risks, and being informed about the intricacies of each can help you make wise investment choices. It’s crucial to develop a solid trading plan and to continuously educate yourself on market conditions, trading strategies, and risk management techniques.

In conclusion, whether you decide to delve into Forex trading or stock trading, knowing the fundamentals and having a well-structured approach will enhance your trading journey and increase your chances of success.