The Ultimate Guide to Online Forex Trading

Online forex trading has become a popular way for individuals to invest and potentially earn profits by trading currencies. The forex market is one of the largest and most liquid financial markets in the world, making it an attractive area for traders. In this comprehensive guide, we will explore the fundamentals of forex trading, important strategies, key factors to consider when choosing a broker, and tips for successful trading. For more in-depth information, you can visit forex trading online exbroker-turkiye.com.

What is Forex Trading?

Forex trading, or foreign exchange trading, involves buying one currency while simultaneously selling another. Currency pairs are the basis of forex trading; for example, in the currency pair EUR/USD, the euro is the base currency while the US dollar is the quote currency. Traders speculate on the price movements of these pairs, hoping to buy low and sell high. The forex market operates 24 hours a day, five days a week, providing ample opportunities for traders around the globe.

How Does the Forex Market Work?

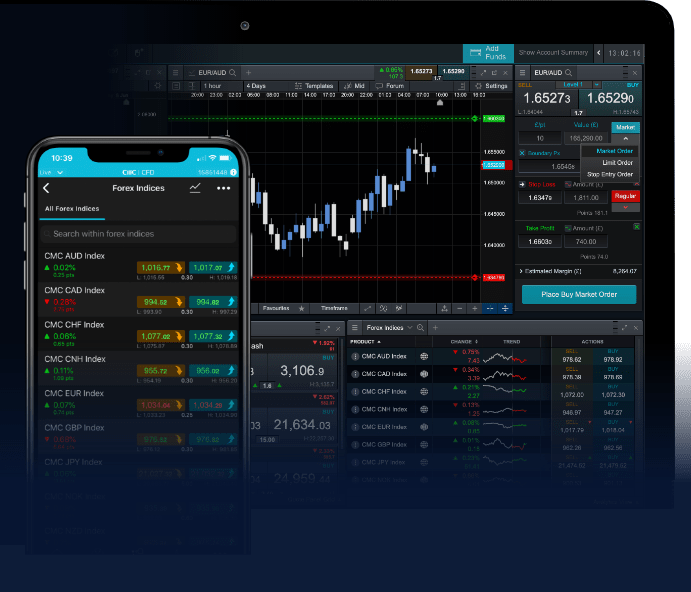

The forex market functions through a network of banks, brokers, institutions, and individual traders. Unlike stock markets, which are centralized, the forex market is decentralized, with trading occurring over-the-counter (OTC). This means that transactions are conducted directly between parties, often through electronic trading platforms. The major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, tend to have higher trading volumes and liquidity, making them the most popular among traders.

Choosing a Forex Broker

Selecting the right forex broker is crucial to your trading success. Here are several factors to consider:

- Regulation: Ensure that the broker is regulated by a reputable authority, which helps protect your funds and personal information.

- Trading Platform: The trading platform should be user-friendly and offer the tools and resources necessary for effective trading.

- Spreads and Commissions: Look for competitive spreads and transparent commission fees to maximize your profits.

- Customer Support: Reliable customer support is essential, especially when you encounter issues or have questions.

- Account Types: Different account types cater to various trading styles, so choose one that aligns with your experience and goals.

Understanding Forex Market Analysis

Successful forex trading requires a solid understanding of market analysis. Traders typically rely on two main types of analysis: fundamental analysis and technical analysis.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, geopolitical events, and other factors that can affect currency values. Traders focus on information such as interest rates, inflation data, employment rates, and monetary policies to make informed trading decisions. Staying updated on global news and economic reports is essential for forex traders who utilize this approach.

Technical Analysis

Technical analysis, on the other hand, relies on analyzing historical price data and patterns to forecast future price movements. This method involves using various charting tools and indicators, such as moving averages, Relative Strength Index (RSI), and Fibonacci retracements. By examining price charts, traders aim to identify trends and entry or exit points for their trades.

Developing a Trading Strategy

A well-defined trading strategy is vital for success in forex trading. Here are some common trading strategies:

- Day Trading: This strategy involves making multiple trades throughout the day to capitalize on short-term price movements.

- Swing Trading: Swing traders hold positions for several days or weeks to capture longer-term market trends.

- Scalping: This high-frequency trading strategy involves making numerous small trades to profit from minor price changes.

Regardless of the strategy you choose, it’s important to have a clear plan, set risk management parameters, and continuously assess and adapt your approach as market conditions change.

Risk Management in Forex Trading

Risk management is an essential part of any successful trading strategy. Here are a few risk management techniques to consider:

- Use Stop-Loss Orders: A stop-loss order automatically closes a trade at a predetermined price to limit potential losses.

- Position Sizing: Determine the appropriate amount to risk on each trade based on your total trading capital and risk tolerance.

- Diversification: Avoid putting all your capital into one trade or currency pair; spread your investments across multiple trades to mitigate risk.

Psychology of Trading

The psychological aspect of forex trading can significantly impact your performance. Emotions like fear, greed, and impatience can lead to rash decisions and ultimately result in losses. Developing a disciplined mindset, adhering to your trading strategy, and managing stress are crucial aspects of successful trading. Consider keeping a trading journal to reflect on your trades, analyze your decision-making process, and identify areas for improvement.

Keeping Up With Market Developments

Staying informed about market developments is essential for forex traders. This includes monitoring economic news releases, central bank announcements, and geopolitical events. Follow financial news websites, subscribe to newsletters, and participate in trading forums to stay abreast of changing market conditions. Many brokers also offer educational resources, webinars, and market analysis tools to assist traders in making informed decisions.

Conclusion

Online forex trading offers exciting opportunities for those willing to dedicate time and effort to learning the market. By understanding the fundamental concepts, choosing the right broker, employing effective trading strategies, and managing risks, you can increase your chances of success. Remember, consistent practice and continuous learning are key to becoming a proficient forex trader. Embrace the journey, stay disciplined, and keep your emotions in check as you navigate the exciting world of forex trading.